Taste of Nature

Invest Now

Raised

$205,404

Days Left

Closed

Business Description

Background

Taste of Nature is a 31 year-old confectionary and snack company that boasts a portfolio of multiple niche category-leading brands. After selling only in movie theaters in the 90s, the Cookie Dough Bites® candy was added to huge retailers – Blockbuster, Walmart, and an assortment of grocery and convenience stores. Today, the company’s products can be found in more than 45 countries across six continents. We are either an industry leader, or a top-five brand, in niche candy categories that many consumer-packaged goods, or CPG, brands aren’t already in; namely edible cookie dough, pre-packaged cotton candy, and chocolate-covered gummy bears.

With a solid lineup of existing product formats, management’s 2022 licensing deal with Mars-Wrigley opens an opportunity to drive higher revenue and margin growth. Based on two of Mars’ biggest-selling non-chocolate brands, Skittles® and Starburst®, Taste of Nature introduced two new cotton candies in the back half of 2022. Further boosting those Mars-branded product launches, in the first quarter of 2023, we launched M&Ms, Twix- and Snickers-branded “poppable” cookie dough snacks. And, in the 2nd quarter of 2023, we launched “spoonable” cookie dough snacks (similar to our Doughlish® Brand) in collaboration with the Snickers®, Twix® and M&Ms® brands!

We have never accepted outside equity investment capital other than Crowdfunding although we have obtained debt financing in the past and currently have outstanding indebtedness.

2023 Financial Highlights

For FY 2023, we will achieve over $40m, which would translate to Revenue Growth of ~40% over 2022 Revenue. In addition to strong top line growth, we’ve also continued to see margin expansion across many items in our portfolio. Overall, we are content with the company’s financial performance as 2023 draws to a close. We’re also pleased to announce that we have plans to issue a one-time dividend to our shareholders by the end of FY 2023.

2023 Highlights

Going into 2023, our biggest and most exciting opportunity was the partnership with Mars Wrigley. In fact, this Licensing Deal drove the entire decision to raise outside capital was to expand our manufacturing facility and hire more people. Currently, we have ~160,000 square feet under lease. We are pleased to announce that we are making great progress on the current build-out in an effort to increase production capacity.

Some of our production lines at certain times of the year are now running 2 ten hour shifts per day, 6 days a week (up from ~10 hours per day, 5 days per week). For this reason, we’ve also expanded our workforce requirement which includes continuing to hire employees directly as well as to employ outside employment agencies to help us as our staffing needs grow throughout this year.

Here are some of our major corporate developments as of the end of Q3-2023:

1. Our new line of Skittles and Starburst Cotton Candy was picked up by Walmart, and can be found in 2,000+ locations across the United States.

2. Target is bringing in several items and at the time of writing, we have both Holiday and Valentine’s promotions scheduled, which means a “seasonal buy” across all ~1,900 stores.

3. Costco Business Center has brought in a pallet program, which is designed as “club pack” for businesses to purchase. During the summer of 2023, they rolled it out to the ~43 business centers across the country.

4. Kroger put in the Skittles and Starburst Cotton Candy Floor Display for a 2023 Summer Promotion.

5. Dollar Tree is carrying multiple SKUs from us as of Q4 2023, and is currently at 5 SKUs, up from 2 earlier in the year.

Opportunity

We believe that we have an opportunity to dramatically accelerate our growth from ~$30m in annual revenue (as of Year End 2022) to $70m+ by 2026. The company recently signed a multi-faceted licensing deal with Mars-Wrigley. The deal includes rights to launch Skittles and Starburst Cotton Candies – Mars’ two largest non-chocolate brands – and the rights to launch M&Ms, Twix and Snickers edible cookie doughs.

For large manufacturers like Mars-Wrigley, “success” may look like a $100m/year product line. While there is no guarantee Taste of Nature can launch a $100m/year product, this licensing agreement may potentially provide the company with an opportunity to do so. Other avenues for growth include possible mergers & acquisitions to expand the product portfolio, as well as additional licensing arrangements and of course continued organic growth.

Thankfully, compared to other consumer staples, candy is already relatively inexpensive to make, which is an advantage candy companies would be able to exploit. It’s not just the younger generation who enjoys candy. Baby Boomers and Seniors are also looking for sweet indulgences.

Problem

In the dynamic world of confectionery, Taste of Nature, with its impressive 31-year legacy, faces a central challenge: the finite nature of shelf space. Having successfully transitioned from exclusive sales in theaters to securing placements in major retail giants like Blockbuster and Walmart, the company’s expansion to more than 45 countries across six continents has been both a testament to its growth and a harbinger of a critical issue. As the market becomes increasingly crowded, the competition for limited shelf space intensifies, putting the spotlight on the need for strategic solutions to maintain and expand visibility.

Solution

To address this challenge head-on, Taste of Nature has strategically embraced innovation and robust marketing. The recently announced 2022 licensing deal with Mars-Wrigley has provided a significant avenue for growth, leveraging the popularity of Mars’ Skittles® and Starburst® brands. The introduction of two new cotton candies in the latter part of 2022, followed by the launch of Mars-branded “poppable” cookie dough snacks in Q1 2023 and “spoonable” cookie dough snacks in collaboration with Snickers, Twix, and M&Ms in Q2 2023, exemplifies Taste of Nature’s commitment to uniqueness and adaptability.

*Image taken at a Sheetz in Pittsburgh, Pennsylvania on December 15, 2023*

The solution to the finite shelf space problem lies in the strategic deployment of marketing initiatives. By creating heightened awareness and a strong desire to experience these innovative products, Taste of Nature aims not only to drive initial purchases but also to establish a loyal customer base, leading to repeat purchases. This, in turn, ensures a sustained presence on the shelves of retailers, solidifying the company’s position in the highly competitive confectionery market. In essence, Taste of Nature’s journey involves transforming the challenge of finite shelf space into an opportunity for growth, fueled by inventive products and compelling marketing strategies.

Business Model

Key Takeaway #1: Licensing Works

As a company, we’d already had years and years of success in terms of structuring licensing agreements. We were obviously excited about what the Mars Wrigley partnership could do for our business.

We also feel like we are just scratching the surface of the potential of this partnership. The “Poppables” just launched in March 2023 and the “Spoonables” in April 2023, so we’re still figuring out just exactly how big of an impact this relationship could have on future growth.

Key Takeaway #2: The Impact of Direct to Consumer Marketing

A lot of people have asked us about our efforts to sell directly to consumers. In the candy business, this can be quite challenging to do, and do well. However, we’re already seeing early signs of demand, and we are currently preparing to expand our online footprint. We’ve recently partnered with an Amazon distributor with an expertise in selling candy through the Amazon platform.

Here’s a look at a few of our listings with them:

– Twix Bars Cookie Dough

– M&M’s Chocolate Candy Cookie Dough

– Spoonables

– 5 oz. Bags

– Skittles Cotton Candy

Key Takeaway #3: Theater Sales are Beginning to Return

After a few years of people saying COVID was the end of the movie theater, and everything was going to streaming, it seems the pendulum is swinging back in favor of the in-person, big-screen experience. While it’s still too early to say the movie theater business is back, over the Summer we saw a sharp increase in orders from this distribution channel as “event” pictures such as Barbie and Oppenheimer (“Barbenheimer”) brought a massive audiences to theatres as this cultural phenomenon brought the boxoffice to tremendous heights.

For this reason, we are optimistic about our future with theatre channel, and we anticipate the we will continuing to drive incremental revenue in this channel.

Market Projection

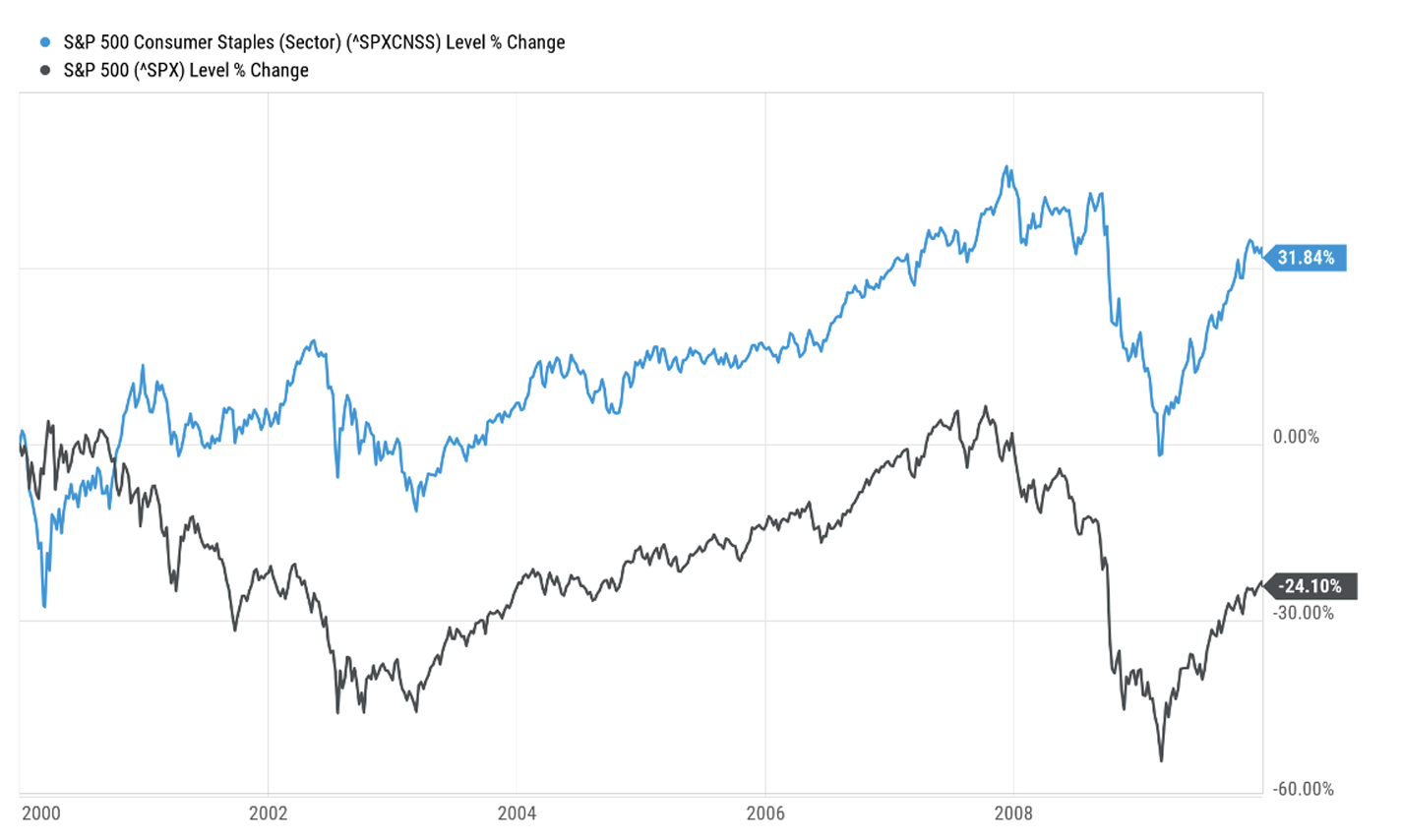

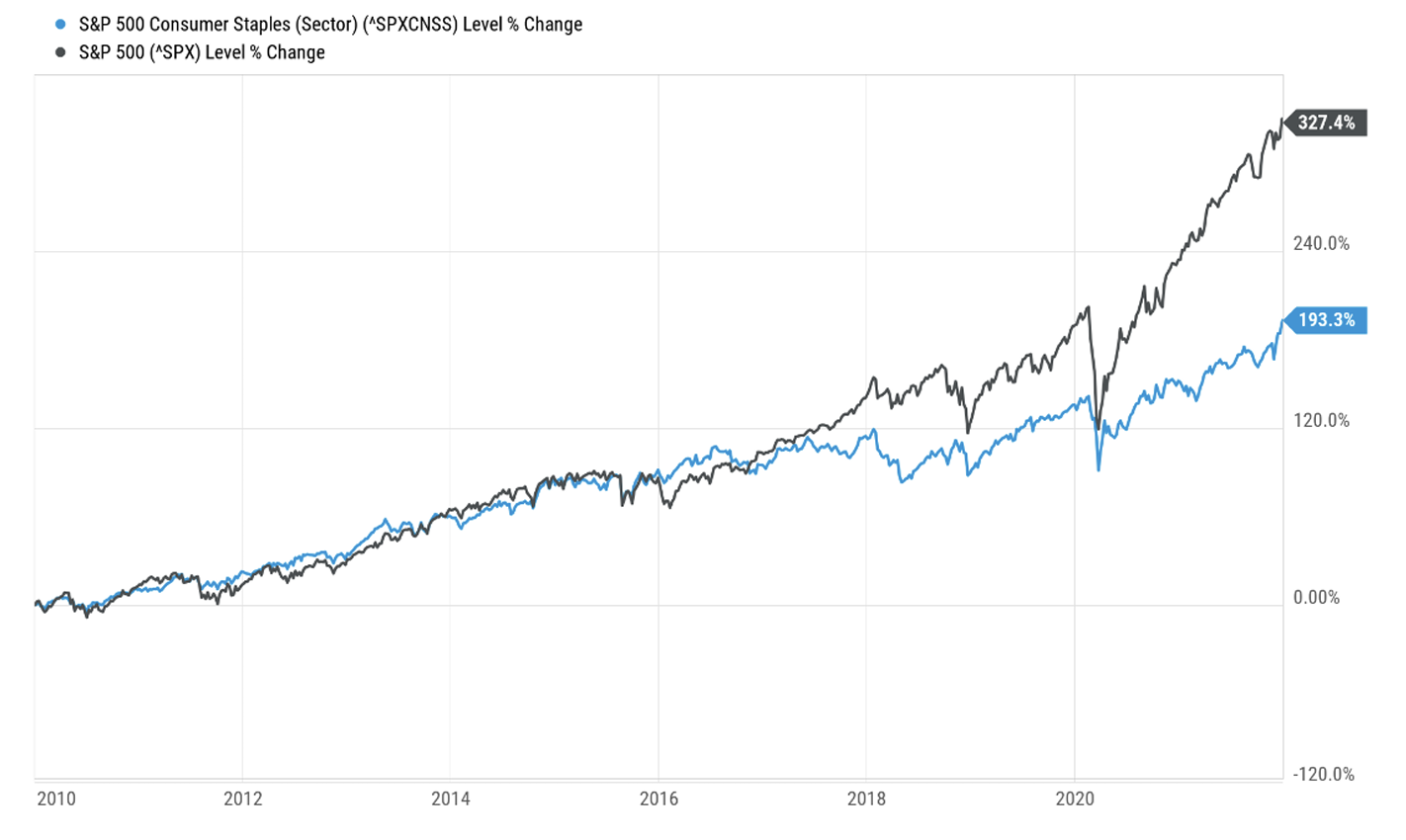

In 1947, the US “Food & Kindred Products” industry added $9,024,912 to the economy – $119,904,252 in 2022 dollars and employed 1,441,847 people. Today, the sector (now called consumer staples) contributes $2 trillion to US GDP, supports 20.4 million jobs, and feeds billions around the world. But after decades of outperformance, the consumer staples industry has struggled to grow since 2009. From 2000 through 2009, consumer staples grew economic profit 10.4% per year, and outperformed the S&P 500 by 55.94%.

From 2010 to 2019 economic profit dropped to 3.2% per year, and in the stock market, it underperformed the S&P by 81.04%, a trend that has only worsened.

In June 2022, the Department of Agriculture (USDA) reported that the food-at-home Consumer Price Index (CPI) reached 13.1%, up from only 1.4% in June 2021. Although the USDA predicts the food-at-home CPI will grow more slowly in 2023, the agency expects this year’s total increase will range from 10 – 11% above 2021. As a result, many consumers have made changes to their grocery choices. While overall spending remains somewhat elevated today, optimism is certainly at an all-time low, especially as high-income households are trading down to club stores and dollar stores to save.

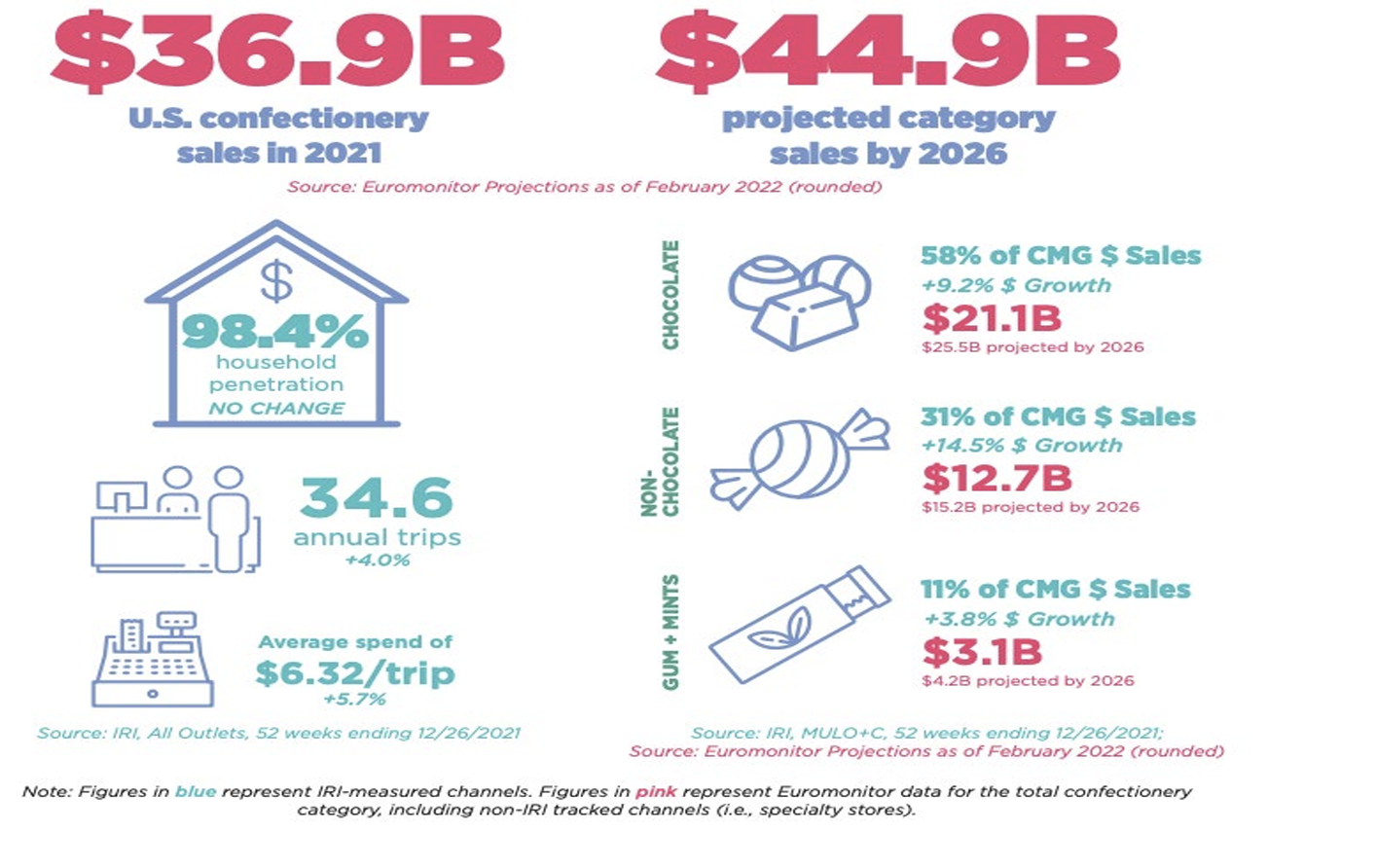

In 2021, the U.S. confectionery sector, more commonly known as “Candy” generated $36.9B in retail sales and is projected to grow to $44.49B by 2026.

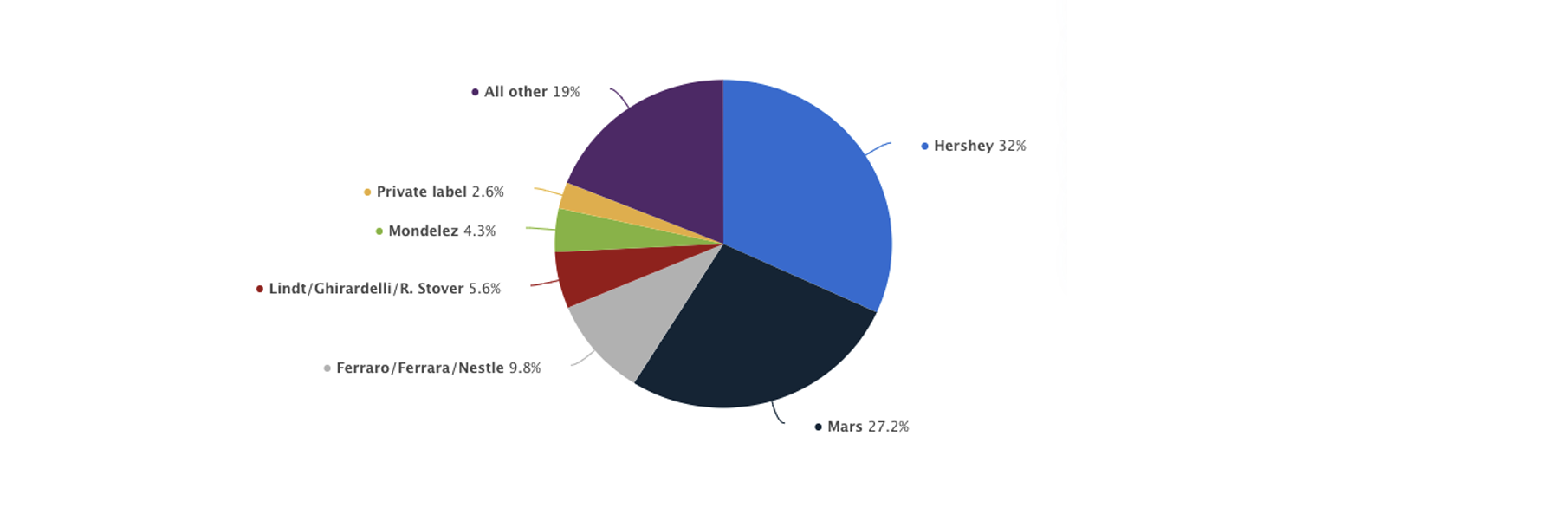

Competition

Today, the entire industry is dominated by five major international companies, combined, they control ~79% of the industry and have collectively outperformed the Consumer Staples industry for the last five years.

1. Mondelez (Nasdaq: MDLZ)

2. Mars-Wrigley (Privately held)

3. Hershey’s (NYSE: HSY)

4. Ferraro/Ferrara/Nestle brands (Privately held)

5. Lindt/Ghirardelli/R. Stover (OTC: LDSVF)

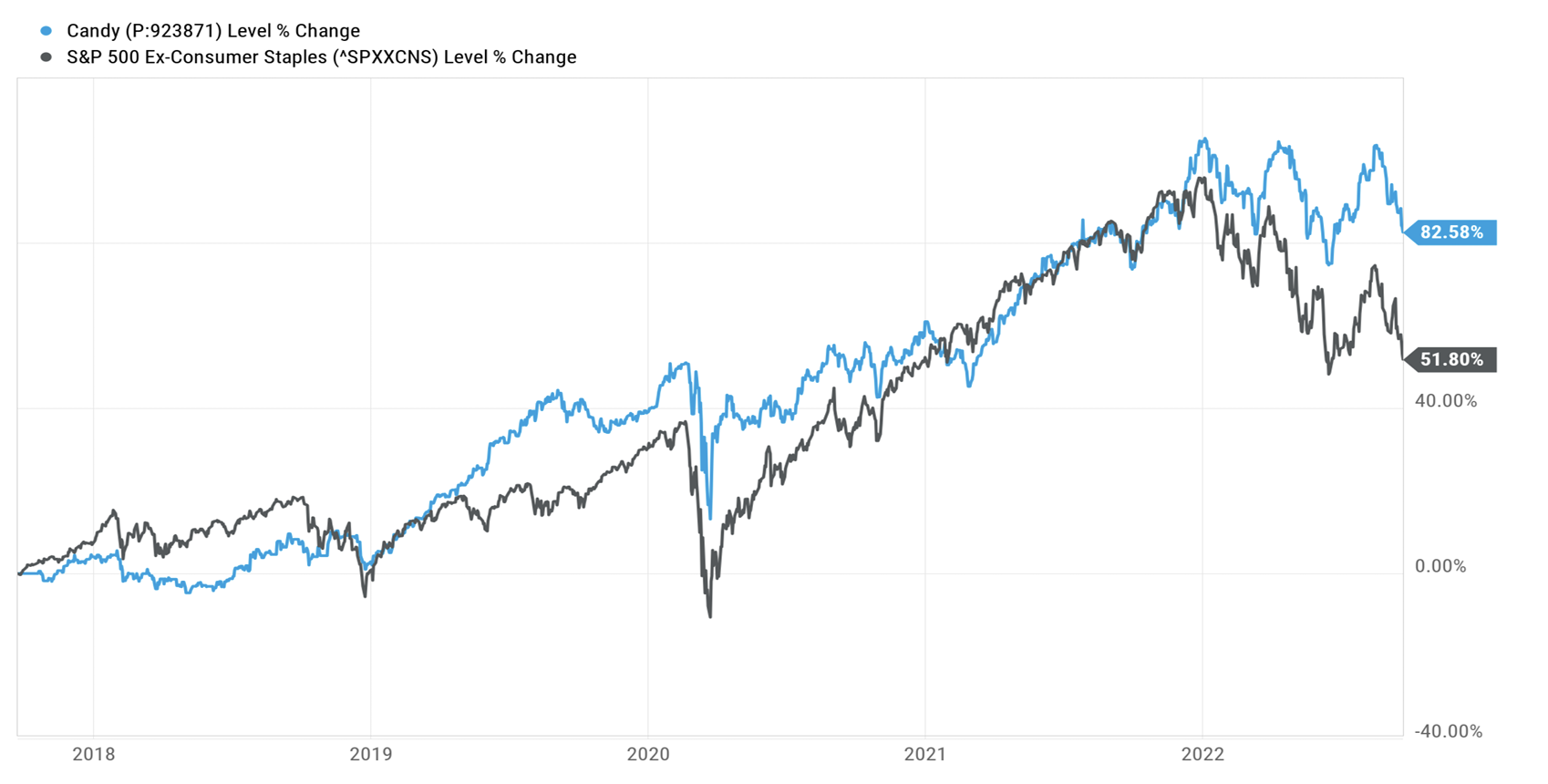

And candy has outperformed the broader S&P 500 (excluding Consumer Staples):

Traction & Customers

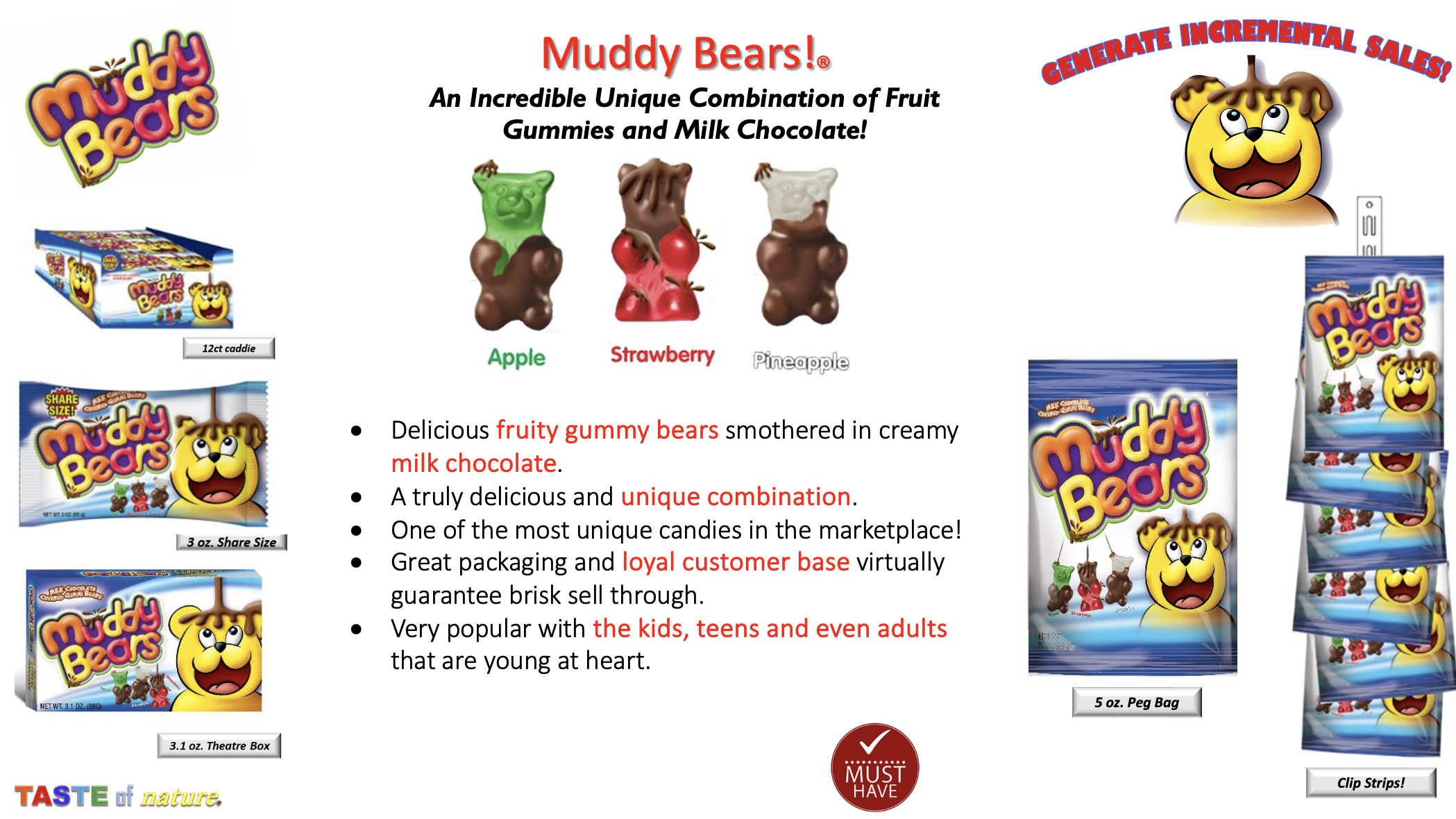

We are a “full line” confectionery and snack food manufacturer with a broad portfolio of candies and snacks that can be offered to a diverse customer base. The best-known and most widely distributed confection that the company manufactures and markets is Cookie Dough Bites®. This confection was developed in the late ‘90s and has grown substantially over the past 25+ years. With the development and growth of Cookie Dough Bites® and the subsequent launching of Doughlish® edible cookie dough, we have become a recognized worldwide leader in cookie dough confections and snacks. Similarly, we have carved out market-leading niches in pre-packaged cotton candy with development of our Swirlz® Cotton Candy Brand as well as several strategic licenses (Hawaiian Punch®, Dr Pepper®, Skittles®, Starburst®) that have led us to be known as a leader and innovator in this space. Together with marketing our unique chocolate-covered gummy bears (Muddy Bears®), these niches have allowed us to grow and become an innovator in several “subcategories” of confections. We are also the exclusive manufacturer of Mrs Fields® Shelf Stable Cookies which allows us to compete in the cookie space with a well-known Brand.

Our products can be found in major retailers like Walmart, Walgreens, Target, Dollar Tree, 7-11, Five Below, Amazon and numerous others. As a further enhancement to our market position, we also have been manufacturing private-label versions of our products for certain select customers.

We believe that competitors in the sector are currently being valued at ~2.5-3.5x forward-looking revenues. We would like to be valued at ~$250m in market capitalization at the time of a public offering if we decide to go public in the future. This means Taste of Nature would be looking to reach the $70m-$100m revenue threshold before considering an IPO.

2023 Financial Highlights

For FY 2023, we will achieve over $40m, which would translate to Revenue Growth of ~35% over 2022 Revenue. In addition to strong top line growth, we’ve also continued to see margin expansion across many items in our portfolio. Overall, we are content with the company’s financial performance as 2023 draws to a close. We’re also pleased to announce that we have plans to issue a one-time dividend to our shareholders by the end of FY 2023.

Investors

Taste of Nature (TON) has never accepted outside investment capital prior to launching their first Regulation Crowdfunding offering in November of 2022. TON launched their Regulation Crowdfunding Offering on the Equifund Crowd Funding Portal in November 2022 and their offering ended in February 2023 with $2,985,643.00 in funds raised.

Terms

Taste of Nature, Inc. will be offering Class A Common Stock at $2.00 per share.

Target Offering: $10,000 | 5,000 Class A Common Stock

Maximum Offering Amount: $2,000,000 | 1,000,000 Class A Common Stock

Type of Security: Class A Common Stock

Offering Deadline: March 29, 2024

Minimum Investment: $1,000

Investors in this round will receive class A common stock with no voting rights per our Amended & Restated Articles of Incorporation.

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $1,000. The Company must reach its Target Offering Amount of $10,000 by April 29, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

If the sum of the investment commitments does not equal or exceed the minimum amount by the offering deadline, no securities will be sold in the offering, investment commitments will be cancelled, and committed funds will be returned without interest or deductions. We have the right to extend the offering deadline at our discretion. You have the right to cancel your investment in the event that we extend the offering deadline and you choose not to reconfirm your investment.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$2.00

Shares For Sale

1,000,000

Post Money Valuation:

$108,389,282

Investment Bonuses!

None.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

March 29, 2024

Minimum Investment Amount:

$1000

Target Offering Range:

$10,000-$2,000,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Scott Samet

CEO

BackgroundScott co-founded Taste of Nature in 1992. Today, he holds over 30 years of experience in selling, distributing, merchandising, and marketing confectionery and snack products to a wide range of retail outlets across the globe. Scott also manages the company’s nationwide sales force across all trade classes. Of special note, in 2012, Scott co-developed the mobile gaming app, Cookie Dough Bites® Factory. Within two weeks of its launch, the game became #1 for kids on iPad and iPhone. In fact, within five months of launching, the game garnered over 2.5 million worldwide downloads. Following, on September 17, 2012, the story made The Wall Street Journal cover. Scott appeared on CNBC’s “The Big Idea with Donny Deutsch,” originally airing in November 2007. And he also made appearances on the Biography Channel’s “Food Factory” in 2014, as well as the Food Network’s “Unwrapped 2.0” in 2015. Both focused on a Taste of Nature’s Cookie Dough Bites. Prior to co-founding Taste of Nature, Scott served as a financial analyst in the mergers and acquisitions department of Bankers Trust in Los Angeles. Scott graduated with his Bachelor of Science in Economics from the Wharton School of the University of Pennsylvania.

Douglas Chu

Co-Founder and Vice President

BackgroundDoug co-founded Taste of Nature in 1992. Today, he holds over 30 years of experience in manufacturing, distributing, merchandising, and marketing confectionery products to a wide array of retail outlets around the world. He also oversees all aspects of the company’s supply chain management, finance, and production. Doug made appearances on the Food Network’s “Unwrapped” and “Unwrapped 2.0” in 2003, 2010, and 2015. Prior to 1992, Doug served as a media and entertainment financial analyst with Bankers Trust in Los Angeles. He holds a Bachelor of Science in Economics, graduating from the Wharton School of the University of Pennsylvania. Together, Scott and Doug’s profiles have been featured in Forbes, The Wall Street Journal, Business Week, Success, Entrepreneur, the Los Angeles Times, and the Los Angeles Business Journal, where they made the cover. As well, the gentlemen were featured in the following books: “Growing and Managing an Entrepreneurial Business” (Allen/Houghton Mifflin); “Nobody’s Business But Your Own” (Brown/Hyperion); “Upstart Startups” (Lieber/Broadway Books); “Young Millionaires” (Lesonsky/Lesonsky and Stodder) and “The Great American Chocolate Chip Cookie Book” (Wyman/Countryman Press).

Company Name

Taste of Nature

Location

2828 Donald Douglas Loop N

Suite A

Santa Monica, California 90405

Number of Employees

37

Incorporation Type

C-Corp

State of Incorporation

CA

Date Founded

June 22, 1992

Raises half the minimum amount

Taste of Nature has raised half of the target offering amount on February 28, 2025. $205,404 has been raised at this time.

Raises 100% of the minimum amount

Taste of Nature has raised the target offering amount on February 28, 2025. $205,404 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.